The landscape of compliance is changing faster than many organizations have been able to keep up with. In healthcare, federal audits and penalties are becoming steeper. What does all this mean? Compliance is now about real-time risk monitoring and accurate documentation, and the ability to adapt has become essential so that auditors don’t find the problem first.

This is where compliance risk analyzers, or compliance risk assessments tools, make all the difference. More focused and detailed than full GRC platforms, think of them as the backbone for modern compliance analysis: systems that track, score, and monitor risk across departments. They provide clear visibility for compliance teams, executives, and boards on where things stand and what needs attention.

This guide explores what compliance risk analyzers do, how they are different from traditional systems, the features that are most helpful, and which tools are leading the market in 2025. We’ll also dig into industry-specific applications, challenges in implementation, and where technology is headed next.

What Is a Compliance Risk Analyzer?

A compliance risk analyzer is a risk assessment software or platform designed to identify and evaluate risks tied specifically to regulations, standards, and internal policies. They are more specialized than other compliance platforms because they are specifically built to focus on the areas that could expose organizations to fines, penalties, and reputational harm.

Compliance risk analyzers are key in identifying risks that may otherwise get buried in spreadsheets or delayed until audit season. Rather than waiting for an annual review or an outside audit to uncover issues, the software flags risks as they develop so teams can deal with them proactively.

These assessment tools also provide the ability to see where the organization stands at any given moment in order to meet the standards of modern healthcare compliance. Risk commonly creeps in through the small gaps; compliance risk analyzers are built to catch those exposures and give teams an opportunity to respond before they become penalties. It’s a way of keeping compliance risk visible day to day.

Core Capabilities

- Risk Identification: Compliance risk analyzers identify exposures across workflows, from incomplete training to outdated agreements. But this is more than just about pointing at a policy gap. A good system can reveal patterns that would otherwise be hard to see without combing through piles of documents.

- Risk Scoring: Risk analyzers or assessment tools have the capability of calculating scores and impact values so leadership can see the risk of the organization at a glance. Scoring risk and compliance in this way provides a clear rating system that shows which issues actually threaten operations and which can wait.

- Monitoring: Another key function of compliance risk analyzers is keeping track of changes in regulations, and how compliance workflows might be impacted, in real time. That means catching a new HIPAA change or CMS update as soon as it posts, but it also means flagging when an internal corrective action is overdue. Both sides matter because an external change without an internal response is what leads to penalties.

- Documentation: The most important part of compliance is documentation, and compliance risk analyzers can create an automatic audit trail that shows what happened, when, and who handled it. Every policy update, follow-up, and sign-off gets logged without someone having to remember to write it down. When inspectors ask for proof, it’s already there.

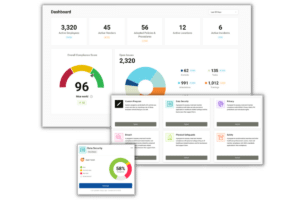

- Reporting: Instead of compiling reports manually, risk analyzers provide templated/automated reports for every compliance need and display data in easy-to-digest dashboards. Decision-makers can easily see which risks are trending up, which have been closed, and where the next focus should be.

A Practical Difference from GRC Tools

The real difference comes down to how they are used. Governance, Risk, and Compliance (GRC) platforms cover every kind of risk across a whole organization. They can be useful, but they’re heavy and take time to get running the way you need. A compliance risk analyzer is a compliance assessment tool built for all the day-to-day work of a compliance team without those extra features they don’t need. It still fits into a larger risk program, it just stays closer to where the risks start and where someone can act on them. A hospital might lean on a GRC platform for broad enterprise reports, but the analyzer is the one catching an out-of-date HIPAA agreement before it turns into a violation.

Key Features to Look For

Not every tool labeled “compliance risk analyzer” is worth the investment. The features below are what separate a system that actually reduces risk from one that just gives you more to manage.

Automated Risk Assessment

Manual risk scoring takes time and leads to inconsistent results. Different people rate the same risk differently, and some people might forget to update scores altogether. A good risk analyzer

can automate scoring to provide a consistent baseline and keeps priorities clear while still leaving room for human input.

Regulatory Monitoring

Regulations change all the time. An effective platform tracks updates across states, agencies, and even countries. That could be a HIPAA update, a CMS rule change, or a new OSHA requirement. The goal is to catch the change early so the team can respond before a regulator finds a gap.

Integration Across Systems

A tool that doesn’t integrate with HR, policy management, vendor oversight, or audit systems is just another silo. Risks don’t stay in one department; they show up across areas such as training records, vendor contracts, incident reports, and billing workflows. Integration lets the analyzer pull data from all those places and give the user a single view of what’s happening.

Analytics and Dashboards

Leaders and decision-makers need to see what’s going on without having to decipher the raw data of compliance. Dashboards that show current status, trending risks, and stuck corrective actions give them that critical time-saving view. It’s about letting leadership see if a risk is getting worse or a department is falling behind without having to wait for a weekly report.

Industry-Specific Modules

Compliance requirements are different in each industry. A hospital needs HIPAA, OSHA, and CMS frameworks. A bank needs AML, SEC, and FINRA alignment. Manufacturers look for OSHA and EPA coverage. Tech companies focus on GDPR, CCPA, and cybersecurity frameworks. A tool that comes with the right templates and regulatory feeds for your industry saves setup time and produces outputs auditors will actually recognize.

Audit Trail

The audit trail is easy to overlook until someone asks for proof. Every corrective action, risk score adjustment, and policy update should be logged automatically with time stamps and user details. An effective compliance risk analyzer provides this information and allows a compliance officer to show exactly when a risk was identified, who approved the plan, and when follow-up was completed.

Automated scoring keeps ratings accurate and consistent. Monitoring catches new rules before they become a problem. Integration pulls information from the multiple places that risk appears so details don’t get lost. Analytics and industry modules turn raw data into something leadership and auditors can understand. The audit trail provides proof of every step. Together, these pieces

are the foundation of a risk analysis platform that gives compliance teams everything they need to manage risk effectively and proactively.

Case Study: When Risk Monitoring Arrives Too Late

A hospital’s cardiac unit kept using an outdated consent form after a state rule was updated, but the change never made it into the shared policy folder. Staff kept having patients sign the old document for weeks, not knowing that it didn’t meet the new standard. When a state survey finally caught it, the hospital had to pay steep fines and re-obtain every patient signature.

A compliance risk analyzer could have flagged the missing policy update and pushed an alert the day the regulation changed, giving the compliance team time to swap the form before patients were admitted.

Top Compliance Risk Analyzer Tools in 2025

The market for compliance risk analyzers overlaps with GRC platforms and risk assessment software, but a few products stand out for doing the detailed compliance work. The tools below are commonly used by healthcare organizations, financial firms, and other regulated industries.

MetricStream

MetricStream is a major GRC provider that offers regulatory change management, control assessment and scoring, and real-time analytics. They support multiple different sectors, and their modules let organizations manage policy, risk, and regulatory content in ways that help visibility.

- Company: Cyber and compliance GRC platform

- Strengths: Regulatory monitoring, customizable dashboards, advanced analytics.

- Best For: Large organizations with complex needs across multiple jurisdictions.

- Considerations: High implementation costs and steep learning curve.

Centraleyes

Centraleyes is a cloud-based risk platform with more than 70 pre-loaded regulatory frameworks and real-time regulatory monitoring. Automated workflows and dashboards tie compliance tasks to those frameworks, giving teams live visibility.

- Company: Cloud-based with focus on automation.

- Strengths: Automated assessments, intuitive dashboards, flexible implementation.

- Best For: Mid-size organizations that need speed and usability.

- Considerations: Smaller vendor still establishing a track record.

Sprinto

Sprinto is a cloud-based compliance platform focused on privacy and security frameworks like SOC 2, ISO 27001, HIPAA, and GDPR. It automates evidence collection, continuous monitoring, and audit preparation to keep systems audit-ready with minimal manual work. Best suited for tech, Sprinto is growing fast and supports many frameworks and integrations.

- Company: Compliance automation provider for tech companies.

- Strengths: SOC 2, HIPAA, ISO built-in frameworks; streamlined workflows for fast audits.

- Best For: SaaS startups and tech firms scaling compliance quickly.

- Considerations: Narrower focus; limited use outside tech.

Compliancy Group

Compliancy Group offers a cloud-based platform for healthcare compliance that supports HIPAA, OSHA, OIG, NIST, ISO, and more. The system combines risk assessments, policy management, training oversight, vendor/contract tracking, and real-time monitoring. A continuously growing company, Compliancy Group’s products are best for the healthcare field.

- Company: Leading healthcare compliance and risk specialists.

- Strengths: risk assessments, vendor oversight, exclusion screening, corrective action tracking.

- Best For: Hospitals, clinics, or other medical facilities.

- Considerations: Specialized in healthcare.

RSA Archer

RSA Archer is an enterprise GRC platform with modules for risk assessments, incident tracking, and regulatory change management. It supports standards such as HIPAA, GDPR, and SOX and is built for large organizations that need compliance risk tied to broader operational reporting.

- Company: Enterprise GRC platform focused on large, complex organizations.

- Strengths: Integration with enterprise risk and operational reporting.

- Best For: Large enterprises that need customizable, enterprise-wide risk and compliance management.

- Considerations: Implementation can be complex; configuration requires time and expertise.

SimpleRisk

SimpleRisk is a GRC platform built with financial services in mind. It lets teams track risks, document policies, and map controls to standards such as GLBA, PCI DSS, and ISO 27001. The core system can run in the cloud or on-premise, with optional modules for added features and automated assessments for internal and third-party risks.

- Company: Finance-oriented GRC platform offering open-source or commercial editions.

- Strengths: Customizable “Extras” modules, questionnaire generation, and maturity scoring that adapt to different regulatory frameworks

- Best For: Financial institutions needing detailed risk tracking and control mapping.

- Considerations: Smaller market presence; implementation resources vary by deployment choice.

Case Study: Healthcare Organization Implements Analyzer Successfully

A regional hospital group adopted Compliancy Group’s platform to replace their fragmented and manual processes. Within the first year, they reported a 40% reduction in time spent preparing for HIPAA audits. More importantly, they uncovered three recurring compliance gaps tied to CMS billing requirements before their reimbursement was impacted. The system saved time and prevented costly penalties.

Implementation Best Practices

Rolling out a compliance risk analyzer takes more than installing software. The work starts before the first login and continues long after the system is live. Careful planning, clear ownership, and steady follow-through make the difference between a tool that delivers value and one that becomes another unused platform.

1. Plan and Prepare

Identify the compliance areas you need to monitor, the regulations that apply, and the processes that create the most work or carry the most risk. Map owners for each process and decide what data must be captured. Without this baseline the tool will only reflect the confusion you already have.

2. Integrate the Right Systems

List the systems the analyzer needs to connect with—HR, training, policy libraries, ticketing tools—and decide which integrations are required on day one and which can wait. Clean old data before import so bad records don’t follow you into the new system.

3. Train and Assign Ownership

Staff need to know how to log incidents, review risk scores, and read dashboards. Managers need to assign ownership and deadlines. Build training into regular meetings and onboarding, and name at least one internal owner who keeps tasks moving and the system current.

4. Manage the Change

People are used to spreadsheets and email chains. Set clear dates for when those end, communicate deadlines, and share early wins to keep adoption on track. Troubleshoot small problems quickly so they don’t become reasons to abandon the new workflow.

5. Measure Results

Decide early how you’ll track success—time saved on audits, number of overdue tasks, frequency of risk reviews—so leadership can see value and the team can refine the process over time.

A compliance risk analyzer only pays off if the organization keeps using the data to guide decisions and avoids slipping back into manual habits. Careful planning and steady follow-through give the system a chance to deliver the efficiency and visibility it’s built for.

Future Trends

Compliance risk analyzers are moving quickly toward more automation and smarter data use. Each wave of products will improve on the capabilities to predict where issues are growing. AI and machine learning are already being added to some platforms to check regulations, flag patterns, and identify gaps for a team member to address quickly.

Predictive analytics is another step forward. By looking at both past incidents and current data, the risk analyzer can calculate where the next failure is most likely to occur. A hospital might see a rising risk score for a department with recurring training gaps. A bank could get an early signal that a pattern of small alerts suggests a larger AML problem. These predictions let teams act and minimize liability.

Automation will continue to improve as well. Data imports, policy updates, and audit reports that used to take weeks can be generated in minutes or even automatically scheduled. This shift doesn’t remove the need for human review, but it reduces the manual work that slows compliance teams and leads to missed deadlines.

Next Steps

Compliance risk analyzers are an operational necessity. They provide visibility across different departments, automate documentation, and give executives the clarity needed to manage risk proactively.

When evaluating solutions, organizations should:

- Define their industry-specific requirements.

- Identify integration points with existing systems.

- Look for automation that reduces manual work.

The right analyzer strengthens the organization’s ability to adapt, protect, and grow. Next step: run a 30-day pilot with your top 2–3 tools, or reach out to our team at Compliancy Group to answer questions.

You can also download our comprehensive guide to risk assessment.