Surprise medical bills can take a variety of forms. Roger Severino, Director of the Department of Health and Human Services’ (HHS) Office for Civil Rights (OCR) recently experienced, first-hand, a case of medical sticker shock. The experience has prompted him to contemplate whether the Office for Civil Rights can “leverage” HIPAA to enable patients to receive information they can use to protect themselves from surprise medical bills.

Does HIPAA Prevent Patients from Receiving Surprise Medical Bills?

The HIPAA law and rules were designed to protect the privacy and security of patient protected health information (PHI) and electronic protected health information (ePHI). Under HIPAA, patients have a number of privacy and security “rights,” including (among others):

- The right to access their medical files;

- The right to request an account of PHI disclosures;

- The right (in certain instances) to permit use or disclosure of PHI only upon patient written authorization;

- The right to amend PHI;

- The right to receive notification of a data breach involving their PHI.

HIPAA does not contain “rights” designed to lower medical costs, however. The law that grants patients such rights is the Patient Protection and Affordable Care Act, commonly known as the ACA, or “Obamacare.” The ACA contains a number of provisions designed to keep the costs of medical care affordable. These provisions include (among others):

- A provision that prevents “Pre-Existing Condition Exclusions” for children under age 19.

- A provision that allows parents to keep their children on their health insurance policy until the children turn 26 years old.

- A provision that prohibits health plans from placing a lifetime dollar limit on the amount of covered health expenses they will pay for.

- A provision requiring insurance companies to spend at least 80% of the money they take in from premiums on healthcare costs and quality improvement activities.

- A provision preventing insurance companies from setting a yearly dollar limit on what they spend for a patient’s coverage.

Neither HIPAA or the ACA, however, prevent surprise medical bills, or, what might be called “Severino Sticker Shock.”

The Story of Severino Sticker Shock

Recently, Roger Severino sustained a foot injury, which required surgery. On the eve of the surgery, Severino’s healthcare provider told Severino that Severino needed to purchase a boot to keep his foot still. Severino paid $423 for the boot. Afterward, he went home and did some research on Amazon. Severino discovered he could have purchased the same thing for under $100.

In a recent interview, Severino stated that, if only he had been informed a few days beforehand, he could have purchased the boot on Amazon, and could have worn it to so that his foot would be immobilized by the time of the surgery.

Enter HIPAA?

Severino, now with firsthand awareness of how patient can face high costs for healthcare, envisions a role for OCR in the area of surprise medical billing.

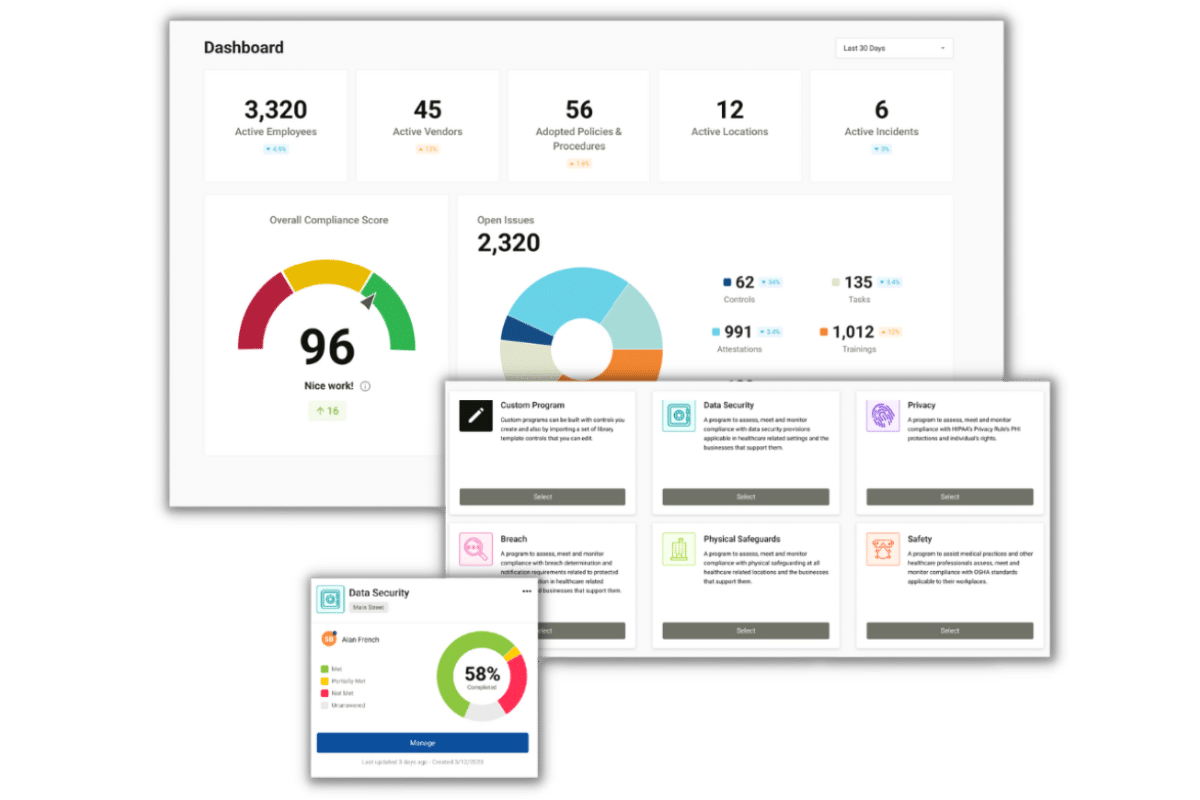

Traditionally, OCR enforcement focused heavily on penalizing providers for failing to keep medical information secure.

In early 2019, however, launched a “Right to Access” initiative, which focuses on ensuring patients receive access to their medical information. Under the initiative, Severino plans to look for ways patients can use medical information to save money on healthcare costs. One approach he is considering: Making sure people can obtain billing records before a scheduled procedure, so patients can avoid high charges…….

Such as $423 for a boot.