Healthcare organizations face mounting pressure to identify, assess, and mitigate compliance risks before they result in costly violations, reputational damage, or operational disruptions. A comprehensive compliance risk assessment serves as the foundation of any effective compliance program, enabling organizations to allocate resources strategically and protect against potential legal and financial consequences.

What Is a Compliance Risk Assessment?

A compliance risk assessment is a systematic process that organizations use to identify where they face potential regulatory violations, evaluate the likelihood and impact of those risks, and implement controls to minimize exposure. This critical evaluation helps organizations understand their compliance obligations, detect vulnerabilities in existing processes, and prioritize remediation efforts based on risk severity.

The assessment process goes beyond simply checking boxes on a compliance checklist. It requires a thorough understanding of applicable laws and regulations, an honest evaluation of current practices, and a commitment to continuous monitoring and improvement.

Why Compliance Risk Assessment Methodology Matters

Implementing a structured compliance risk assessment methodology provides organizations with a repeatable framework for identifying and managing regulatory risks across all business operations. A well-designed methodology ensures consistency, enables trend analysis over time, and creates a defensible record of compliance efforts.

Key components of an effective methodology include:

Risk Identification: Cataloging all applicable regulations, industry standards, and contractual obligations that govern your organization’s operations. This includes federal and state laws, international regulations for global operations, and industry-specific requirements.

Risk Analysis: Evaluating each identified risk based on two critical factors: the likelihood of occurrence and the potential impact if the risk materializes. This analysis considers existing controls, historical compliance performance, and emerging regulatory trends.

Risk Prioritization: Ranking risks to determine which pose the greatest threat to the organization. High-priority risks typically combine high likelihood with severe potential consequences, including substantial fines, legal liability, operational disruption, or reputational harm.

Control Assessment: Examining current policies, procedures, and safeguards to determine their effectiveness in mitigating identified risks. This step reveals gaps where additional controls are needed or existing measures require strengthening.

Remediation Planning: Developing action plans to address identified gaps and reduce residual risk to acceptable levels. Plans should include specific tasks, assigned responsibilities, timelines, and success metrics.

The Compliance Risk Management Process: From Assessment to Action

While assessment identifies risks, the broader compliance risk management process transforms those insights into meaningful action. This ongoing cycle ensures organizations maintain effective compliance programs that adapt to changing requirements and business conditions.

The compliance risk management process typically follows these stages:

Planning and Scoping: Defining the assessment’s boundaries, identifying stakeholders, gathering documentation, and establishing the evaluation timeline. This phase sets clear objectives and ensures all relevant areas receive appropriate attention.

Data Collection: Gathering information about regulatory requirements, current practices, past compliance issues, and control effectiveness. This may involve document reviews, employee interviews, system audits, and analysis of compliance metrics.

Risk Evaluation: Applying the organization’s risk assessment methodology to analyze collected data, rate risks, and identify control gaps. This analytical phase transforms raw information into actionable intelligence.

Reporting and Communication: Documenting findings in clear, accessible formats that enable stakeholders at all levels to understand compliance risks and required actions. Effective reporting bridges the gap between technical compliance details and business decision-making.

Remediation and Monitoring: Implementing corrective actions, tracking progress, and continuously monitoring for new risks or changes in existing risk profiles. This ongoing vigilance ensures the compliance program remains effective over time.

Learn more about risk assessment in our comprehensive guide.

Common Challenges in Compliance Risk Assessment

Organizations frequently encounter obstacles that hinder effective compliance risk assessment:

Resource Constraints: Limited staff, budget, or expertise can make comprehensive assessments difficult, particularly for smaller organizations or those with complex regulatory environments.

Regulatory Complexity: The sheer volume and technical nature of applicable regulations can overwhelm compliance teams, especially when operating across multiple jurisdictions or industries.

Data Silos: When compliance information resides in disconnected systems or departments, obtaining a complete picture of organizational risk becomes challenging.

Changing Requirements: Regulatory landscapes evolve constantly, requiring organizations to stay current with new requirements and update assessments accordingly.

Documentation Burden: Creating and maintaining evidence of compliance efforts consumes significant time and resources, often diverting attention from strategic risk management activities.

How The Guard Transforms Compliance Risk Management

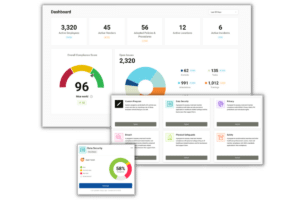

Compliancy Group’s software platform, The Guard, addresses these challenges head-on by streamlining every aspect of the compliance risk management process. Rather than cobbling together spreadsheets, filing cabinets, and manual tracking systems, organizations can centralize their entire compliance program in one intuitive platform.

Automated Risk Tracking and Identification

The Guard continuously monitors your compliance landscape, automatically identifying areas of risk and alerting teams to potential vulnerabilities before they become violations. This proactive approach replaces reactive scrambling with strategic prevention.

The platform’s intelligent tracking system maintains a comprehensive inventory of your compliance obligations, mapping them to specific business processes and control activities. When regulations change or new requirements emerge, The Guard flags affected areas and guides you through necessary updates.

Streamlined Policy Management

Managing policies and procedures across an organization presents significant challenges. The Guard simplifies this critical function by providing:

- Centralized policy libraries with version control and approval workflows

- Automated distribution ensuring all employees receive current policies

- Attestation tracking that documents employee acknowledgment and understanding

- Scheduled policy reviews preventing outdated procedures from creating compliance gaps

As one compliance officer noted, “With Compliancy Group’s software, we know if people are reading policies and attesting to them, or not. You can sleep a little better knowing that there’s something in place.”

Comprehensive Documentation and Audit Trails

When audits or investigations occur, organizations must produce evidence demonstrating compliance efforts. The Guard automatically creates detailed documentation throughout your compliance activities, building an audit-ready record without additional effort.

Every action taken within the platform generates time-stamped records: risk assessments conducted, controls implemented, training completed, policies reviewed, and incidents addressed. This comprehensive audit trail provides defensible evidence of your compliance program’s effectiveness.

Simplified Risk Assessment Workflows

The Guard transforms complex compliance risk assessment methodology into guided workflows that lead teams through each necessary step. Rather than starting from scratch or adapting generic templates, organizations follow structured processes tailored to their specific regulatory requirements.

These workflows incorporate industry best practices and regulatory guidance, ensuring assessments meet both internal needs and external expectations. The platform’s built-in expertise