In addition to ensuring their organization’s adherence to regulations and overseeing a compliance program, compliance officers must also perform comprehensive risk management. This part of the compliance officer’s job can be daunting by itself.

However, the most efficient compliance officers know the tools and resources to make this role more manageable. For example, understanding the particulars of the risk management process can help you identify areas that benefit from using compliance software.

How Compliance Officers Manage Risk in the Healthcare Organization

Risk management helps compliance officers and other individuals identify, evaluate, and mitigate risks and potential losses that result from regulatory noncompliance. Also, when tracking changes in regulations and standards, managing risk allows for identifying factors that prevent the organization from fulfilling all federal and state healthcare and program funding requirements.

Because risk management is a complex process that involves multiple tasks, it may appear to be a separate job outside of the compliance officer’s realm. However, identifying and mitigating risks are essential to safeguarding workers and keeping the organization compliant. Compliance officers also must work with healthcare providers and organizational leaders to pinpoint potential risk factors, analyze their impacts, and generate or improve protocols to make corrective responses to instances of non-compliance.

Within healthcare contexts, compliance officers manage risks to protect:

- Patient well-being, safety, and privacy

- Protected health information (PHI) and other sensitive data

- Information technology and cyber infrastructure of the organization

- Employee safety and privacy

- The organization’s financial stability

- The reputation of the healthcare facility or hospital

Compliance officers must constantly be vigilant of risk factors that could threaten all members and elements of the healthcare organization. Risk management enables officers to even look for risks that are hard to anticipate, especially those that are unlikely but realistic, given the organization’s vulnerabilities. Furthermore, the risk management process includes the following functions:

- Conduct comprehensive risk assessments—Regularly identify vulnerable areas, pinpoint risk factors, assess their potential impacts, and offer recommendations for mitigating them. The compliance officer can encourage the organization to integrate regular risk assessments into its compliance program.

- Develop policies and procedures—Use risk assessment results to create protocols for maintaining and improving compliance, thereby reducing the impact of potential risks.

- Monitor and audit regularly—Continuously surveil the work environment for recurring and novel risk factors, which get tracked.

- Schedule training—Educating staff on regulatory compliance and taking steps to help the organization reduce risk.

- Facilitate a culture of compliance—Helping create an environment that values compliance with standards and regulations, comprehensive training, transparent policies, and open communication.

- Encouraging and protecting whistleblowers—Create a workplace that’s safe to report incidents and raise concerns about non-compliance. Have protections in place so that whistleblowers don’t experience repercussions.

Technology Tools for Compliance Officers and Risk Management

The best compliance officers possess several skills that contribute positively to the risk management process:

- Analytical skills

- Communication

- Detail orientation

- Integrity

- Leadership

- Teamwork

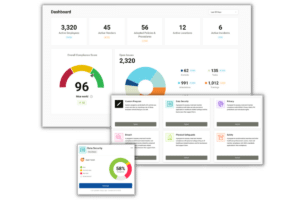

Another critical skill of effective compliance officers is knowing which tools to rely on to streamline the risk management process. Compliance service providers like Compliancy Group offer compliance software packages that take the headaches out of risk management and other functions that compliance officers perform. Compliance software can streamline your risk management process by helping you:

- Set up reminders for regular monitoring and auditing activities

- Track and manage the risk management micro tasks

- Create reports of risk assessments

- Formulate policies and corrective actions

- Track changes in compliance regulations

- Ensure personnel at all locations fulfill training requirements

In general, compliance software can help you automate many tasks, which increases efficiency, prevents administrative errors, and leaves more time for the analytical and collaborative work of risk management.

At Compliancy Group, we help compliance officers in various healthcare settings streamline their risk management processes. Contact us today to learn about our software packages and the personalized guidance we offer.