Many online guides promise to help you make this transition in five easy steps or guarantee success if you “simply follow this fool-proof plan.” Recent trends toward consolidating medical care into larger groups and practices make starting your practice much more complicated than it was even 20 years ago.

More complicated does not mean impossible. Starting a medical practice requires planning, discipline, dedication, and a realistic grasp of expectations. This article will examine several make-or-break steps to investigate, including one that may surprise you.

Where?

The second habit in the now-ubiquitous book “The 7 Habits of Highly Effective People” is “Begin With the End In Mind.” The decision to open your practice will have a powerful impact on the future of your career, your family, and your finances. Whether that impact is positive or negative depends on how well you plan.

One of the most important considerations is choosing where to open your practice and does it make sense for the kind of medical care you provide. A pediatrician or pediatric dentist might have serious issues opening an office in an area with declining birth rates, just as a practice specializing in geriatric care might steer clear of Provo, Utah, where the median age is 23.3.

How Much?

The first thought most have when they see the “how much” question is money. “How much will I need” and “how much will I make” are two critical considerations. However, discovering practical answers will require sitting down to create a formal business plan.

Your business plan should encompass as many details as you can reasonably imagine, including costs to lease (or buy) office space for your practice, payroll for staffing, business taxes, fees, operating capital needed until cashflows begin to appear, and countless other items. Speaking of cashflows…

When?

Understanding how insurance reimbursement works and when to expect payments is essential unless you plan to open a Direct Primary Care clinical model and require patients to file for reimbursement with their insurance companies. One rule of thumb is that 60 percent of your funding should be cash flow positive in 30 days or less from the service date. This will keep your private practice financially moving in the right direction.

According to a recent article online, an insurance claim filed electronically is usually paid in about two weeks if there are no issues to slow it down. Insurance claims filed on paper typically take at least 30 days to process, and particular circumstances or errors will extend this period.

Who?

You’re opening your practice, but you won’t be able to do everything yourself. Who will you hire to help you make your dream come true, and where will you find them?

Many medical professionals depend upon close friends or family members for support, and some are fortunate enough to have qualified professionals and paraprofessionals who can join the team. The people you choose will represent you and your brand; in many cases, they will interact more with your patients than you do. Remember that their actions will directly reflect how you are perceived, including your demeanor, abilities, and competence.

Compliance

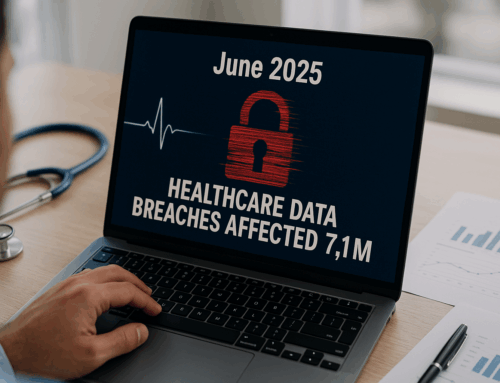

You may think compliance is simply a box to be ticked, a necessary evil that’s part of the cost of doing business. Nothing could be further from the truth. Medical professionals face stringent legal and regulatory standards, ranging from licensing, earning board certifications, and being accepted for insurance reimbursement.

But incorporating HIPAA compliance into your business practices is a decision that will pay immediate and long-term dividends. It will help protect your professional reputation by demonstrating your vigilance in securing patients’ protected health information (PHI).

It will minimize the likelihood of breaches and successful attacks by cybercriminals, which could paralyze your practice operations.

HIPAA rules and regulations require that HIPAA-compliant businesses have business associate agreements with vendors who must take possession of PHI as part of their services. These agreements help you establish liability and can shield you in case of a vendor breach.

The law also requires any vendor that takes possession of PHI to meet HIPAA’s privacy and security standards. It mandates annual security risk assessments, policies and procedures, and staff HIPAA training covering cybersecurity and patient privacy.

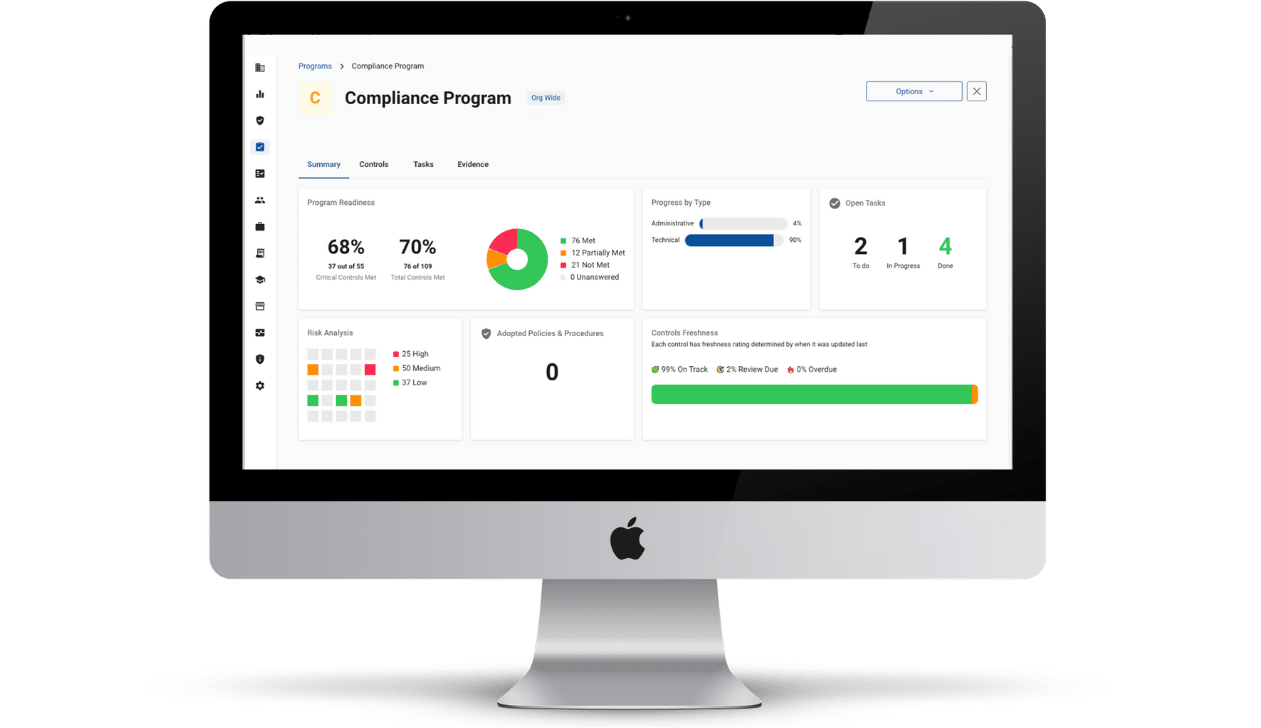

The good news is that Compliancy Group can help you master HIPAA Compliance from the beginning, keep you up to date with any changes in the law, and remind you when tasks need to be completed.

Before you open your doors to your new practice, talk to one of our HIPAA professionals and let us simplify your healthcare compliance.

Read this case study to learn about how we helped this sole-practitioner startup.