HIPAA Compliance for Self-Insured Companies and Group Health Plans: Protecting Sensitive Data

HIPAA regulation extends far beyond the realm of doctors and medical practices, reaching self-insured companies as well. In order to safeguard sensitive health data, self-insured organizations and group health plans are considered covered entities under HIPAA. Let us highlight the importance of HIPAA compliance for such entities and offer a comprehensive solution for managing this complex process.

Understanding the Scope of HIPAA Regulation

Covered entities, including self-insured organizations and employee-sponsored group health plans with more than 50 participants or those administered by third parties like HMOs or insurance carriers, must comply with all aspects of HIPAA privacy and security regulations. This is crucial to protect individual’s health information as required by law.

Mitigating Risk Through Effective Compliance Programs

To avoid devastating data breaches and subsequent HIPAA violations, it is essential for these entities to implement an effective HIPAA compliance program. Failure to do so can lead to financial penalties that may amount up to $50,000 per incident- a cost that most self-insured businesses cannot afford.

Expanding Coverage

Self-insured companies offering various group health plans such as:

- Dental

- Vision

- Prescriptions

- Medical Coverage

- Workers’ Comp

- Disability

These plans must also ensure compliance with HIPAA regulations. It is imperative to safeguard all types of sensitive health information across these different areas.

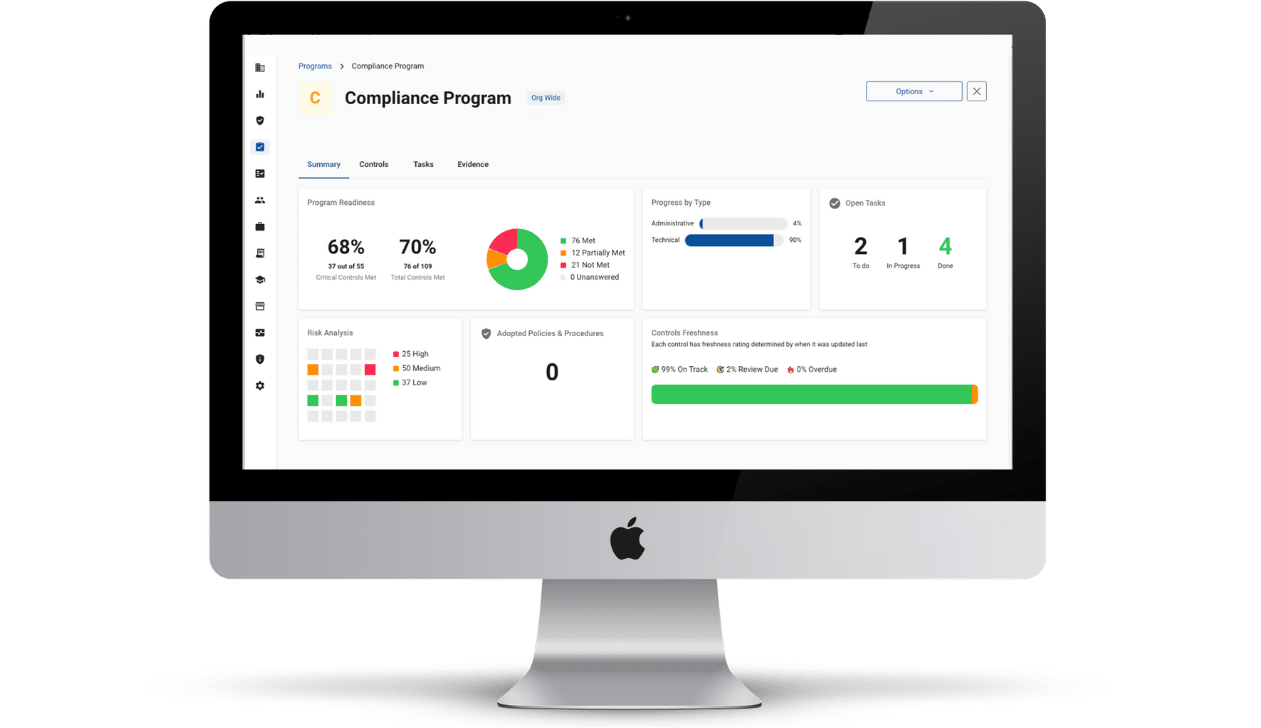

Taking Control with Compliancy Group’s Solution: The Guard & Guidance

Compliancy Group offers a cloud-based compliance solution called The Guard, specifically designed to address the comprehensive federal regulations of HIPAA. By utilizing this powerful tool, self-insured organizations gain control over their HIPAA compliance endeavors.

With Compliancy Group’s team of expert Compliance Coaches available to provide weekly guided walkthroughs during the implementation process, self-insured organizations can rest assured that they are doing everything correctly from the start. This personalized guidance ensures a smooth and thorough approach to HIPAA compliance.

For self-insured companies and group health plans, complying with HIPAA regulations is not just an option but a legal requirement. By implementing Compliancy Group’s cloud-based solution, The Guard, and taking advantage of their expert Compliance Coaches, these entities can confidently protect sensitive health data, mitigate risks, and avoid costly violations.

Self insured plans are subject to the full HIPAA regulation requirements even if they use a third party administrator.

Fully Insured plans are limited based on whether or not they handle PHI