On average, all it takes is one noncompliance event for an organization to lose $5.87 million in revenue alone. With the heat of monetary losses increasing and worsening each year, more organizations are prioritizing compliance risk management. The primary way of counteracting the potential for, or the adverse effects of, noncompliance is by utilizing a regulatory compliance risk assessment.

Considering that noncompliance has surpassed 45% in just 10 years, organizations don’t want to navigate it blindly. A healthcare compliance assessment is a proven way to give organizations clarity into their compliance misfalls. However, to be effective, employers should understand what it is, how it applies to their organization, and how to use it.

How Is Compliance and Risk of Noncompliance Measured in Healthcare?

Compliance is measured by using specific compliance management tools. For many businesses, regulatory compliance risk assessments are the tool of choice. To start, these measurements are applied after establishing a baseline for your organization’s compliance goals. Setting KPIs helps form opportunities for better decision-making, pinpoint areas where improvements are needed, and identify the root causes of gaps in compliance.

The risk of failing to comply with specific regulations can be challenging to measure, and this is where a regulatory compliance risk assessment template proves to be useful, especially to avoid certain types of impacts that noncompliance can expose your business to.

Operational

Noncompliance hinders day-to-day operations and increases the chance of downtimes, evolution with market demands, and regulatory complexities.

Financial

Regulatory fines for noncompliance can be significant in value and aren’t often budgeted by businesses because being noncompliant is never planned. Without conducting compliance assessments, you also run the risk of having to navigate remediation efforts, increased operational expenses, and loss in revenue.

Reputational

Not only can noncompliance affect your brand image and the level of trust you get from consumers, but it also affects patient or client acquisition and general perception from the public. Compliance breaches don’t stay a secret and can harm client retention, and future partnerships.

Legal

Without a proactive approach to compliance, businesses increase the chance of regulatory audits, regulation violations, and adverse legal action.

What Is a Regulatory Compliance Risk Assessment?

A regulatory compliance risk assessment is an extensive review process. This tool gives organizations a structured process to help identify, evaluate, and mitigate various risks.

The goal of this assessment is to help determine whether what you are currently doing to achieve and maintain a level of compliance is a sound strategy or whether there are specific areas of improvement when it comes to exposure to certain types of risk.

Market Risk

Without regulatory assessments, healthcare entities are at a higher risk of compromising their competitive position in the market. This may expose a business to financial instability or being behind market demand and compliance updates.

Regulatory Changes

Without healthcare compliance assessments, it becomes more possible to overlook crucial regulatory changes. This will ultimately lead to noncompliance.

Data Protection and Breach Prevention

Data breaches can tarnish the reputation of any type of company, but aside from reputational impacts, these incidents can also lead to financial repercussions such as remediation costs, legal fees, and potential lawsuits.

Mishandling Protected Health Information (PHI)

Mishandling protected health information (PHI) could result in severe penalties, from fines and sanctions to inaccurate response to regulatory audits.

Navigating the Steps to Compliance Risk Assessments

A healthcare compliance assessment bridges the gap between what your current compliance solution is already doing and what it should be doing. In other words, it’s the foundation of your compliance program.

The simplest way to know what strategies you should use to complement your compliance program and limit the amount of risk your business is exposed to is to assess your risk exposure by following certain steps to perform a regulatory compliance risk assessment.

Identify and Classify Risk Types

Conduct a comprehensive review of potential risks and categorize them based on severity and the chance of reoccurrence. You could perform this type of review by completing a documentation review, using a root cause analysis, or an assumption analysis.

Evaluate Inherent Risk

Assess the inherent risk associated with each identified risk. You can do this by considering external factors and industry/market standards.

Prioritize Risk Types

Prioritize risks based on their potential impact on the organization and the likelihood of reoccurrence.

Implement Mitigation Strategies

Start developing and implementing strategies to mitigate the identified risks, including custom policies, procedures, and training for staff.

Continuously Monitor

Monitor and review the effectiveness of the implemented mitigation strategies, adapting them as needed. You will also want to communicate any findings to relevant stakeholders or compliance team members.

Within your assessment, the basic idea is to include everything associated with compliance—your organizational structure, training, and general operations. Keeping up with compliance and assessing it correctly can seem like a difficult task, but using a regulatory compliance risk assessment sample can help mitigate any difficulty and reduce financial waste during an initial evaluation.

How Compliancy Group Is Simplifying Compliance Assessments

Ensuring your organization follows regulatory compliance requirements can overwhelm any business. The main areas of difficulty are when compliance programs aren’t risk-based, the program’s implementation has lacked effectiveness, and the associated policies are overly complex.

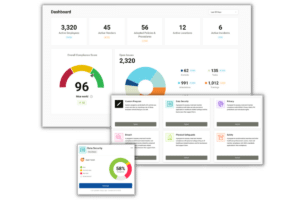

Now, executives are seeking solutions to increase efficiency, score risks to help better prioritize their resources, and track their progress in real time while reporting on their efforts to monitor compliance and implement action plans. Experience how Compliancy Group’s all-in-one software can enhance your organization’s compliance by scheduling a demo today.