Compliance in all healthcare settings requires an in-depth understanding of the standards that the U.S. Office of Inspector General (OIG) enforces. However, OIG corporate compliance oversight is typically more rigorous, often resulting in more severe consequences for violations.

In any business setting within healthcare, maintaining high standards ensures ethical practices, reduces financial waste and abuse, protects the organization’s reputation, and promotes quality of patient care.

When OIG Evaluation of Corporate Compliance Programs Turns Up Wrongdoing

Compliance officers, and the compliance programs they oversee, represent the backbone of stringent adherence to federal, state, and internal standards of conduct. Minimizing their importance can be costly. For example, the average healthcare data breach in 2023 cost almost $11 million to resolve.

The threat of financial loss isn’t the only reason to maintain corporate compliance. Healthcare corporations that fall short of essential compliance requirements must answer to the U.S. Department of Justice. Furthermore, when an OIG measurement of compliance program effectiveness uncovers unethical behavior or costly errors, a liability judgment can fall on the board of directors, not just the compliance officer.

A corporation liable for a compliance violation can enter a corporate integrity agreement (CIA) to reduce its penalties or prevent exclusion from essential programs like Medicare. The CIA outlines the organization’s obligations for correcting wrongdoing and improving corporate compliance measures. Most CIAs last five years.

The Role of Compliance Officers in Maintaining OIG Corporate Compliance

Successful corporate compliance is largely due to the efforts of the compliance officer, the person responsible for overseeing the organization’s compliance with various OIG regulations. The compliance officer helps develop, carry out, and monitor the company’s compliance program, which provides a system of procedures for identifying and mitigating risk. Compliance programs enable compliance officers and others in leadership to take measures to protect the organization against instances of non-compliance.

Compliance officers are accountable to critical players in the organization, especially when the organization falls short of its regulatory compliance. They must answer to the board of directors by providing results of OIG evaluations of the corporate compliance program, updates for ongoing investigations, changes to state and federal regulations, and other information to help these leaders comprehend organizational risks and recommend the best actions.

OIG Corporate Compliance Software Can Help

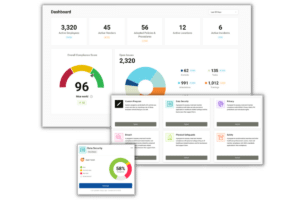

Overseeing all the operations and functions of a corporate compliance program can be daunting for even the most proficient compliance officers. Helping the organization avoid noncompliance’s legal and financial implications requires tools and resources to continually identify risks, reduce liability, and foster a compliance culture. That’s where corporate compliance software can make a significant difference.

Close to 3,000 healthcare organizations currently use one or more software packages to ensure corporate compliance and safeguard patient and worker safety and well-being. Software from service providers like Compliancy Group can help compliance officers stay informed about regulatory changes, provide deadline reminders and alerts, track employee training progress, compile reports, monitor compliance activities, and streamline incident report intake. Measuring OIG compliance program effectiveness can also occur in one centralized system, reducing workflow redundancies.

Maintaining OIG corporate compliance depends greatly on streamlining your compliance tasks. If you want to know what compliance management tools can do for your organization, talk to our team at Compliancy Group.