When the Health Insurance Portability and Accountability Act was signed into law in 1996, it ushered in a series of changes to how healthcare operates. The federal law established baseline standards for protecting the health records of patients, and it also gave patients greater rights to access their health records.

The law also added a level of confusion to a complex marketplace. Today, 26 years after it became law, healthcare providers and their business associates still need help understanding if and how the law applies to their operations. It is vital to understand the importance of HIPAA in protecting your business.

The Importance of HIPAA – It’s the Law

It may be stating the obvious, but the first thing that gives HIPAA importance is that it is federal law. Enforcement of HIPAA falls under the purview of the Department of Health and Human Services, specifically, the agency’s Office for Civil Rights. The primary focus of the law is controlling the privacy and security of patients’ protected health information (PHI).

More than 314,000 complaints have been made to OCR since April 2003. The agency conducted at least 44,000 investigations (14 percent of all complaints), and 68 percent of investigations resulted in some form of corrective action.

Corrective action for a HIPAA violation can be as simple as providing guidance to a provider. More severe incidents can lead to HIPAA fines and years of additional oversight by OCR auditors.

HIPAA auditors have a reputation for trying to help providers and business associates in less punitive ways if there is cooperation. Failure to cooperate carries substantial consequences. This year, two healthcare providers were each fined $100,000 for patient right of access violations. In both cases, the providers ignored HIPAA requests for information or provided token cooperation.

The Importance of HIPAA – It Helps Protect Patient Health Data

The information contained in the PHI of patients is some of the most sought-after information by cybercriminals. If that information falls into the wrong hands, bad actors will open credit lines in patients’ names. This damages the reputation of those affected by identity theft and can result in hours spent trying to prove what really happened and loss of credit standing.

HIPAA does not protect patient PHI, nor does it tell you how to do so. Instead, HIPAA establishes minimum standards through the HIPAA Privacy Rule and the HIPAA Security Rule.

The HIPAA Privacy Rule is focused on controlling access to PHI so that it is only accessed by those who need to do so. This Rule deals with administrative safeguards such as policies and procedures and practical precautions like access control measures where physical or electronic files are stored.

The HIPAA Security Rule focuses on how the data is protected through encryption, virus and malware filtering, firewalls, and multi-factor authentication. Along with the HIPAA Breach Notification Rule, these regulations form the foundational basics of protecting patients’ sensitive health data.

The Importance of HIPAA – Protecting Your Reputation and Limiting Liability

HIPAA compliance does not guarantee that a breach will never expose PHI. The auditors and regulators at HHS understand that it is impossible to prevent every possible breach.

HIPAA compliance means you have made and can demonstrate a good-faith effort to follow HIPAA’s rules and regulations. If you aren’t in compliance, you can expect a breach to result in lawsuits from the plaintiff’s attorneys representing patients whose data was exposed.

A breach that results from non-compliance could result in negative publicity and severely undermine the trust and goodwill of your clients. There are cases where a breach has resulted in a company or practice going out of business because of the costs associated and the damage to their reputation.

Many companies will try to mitigate the adverse effects of a breach by purchasing insurance. Be aware that cybersecurity insurance that will protect you from the liability caused by breaches is usually a separate product from general business liability coverage. Within the past year, many insurers now require insured companies to comply with all regulatory requirements to file a claim successfully.

The Importance of HIPAA – A Solution for You

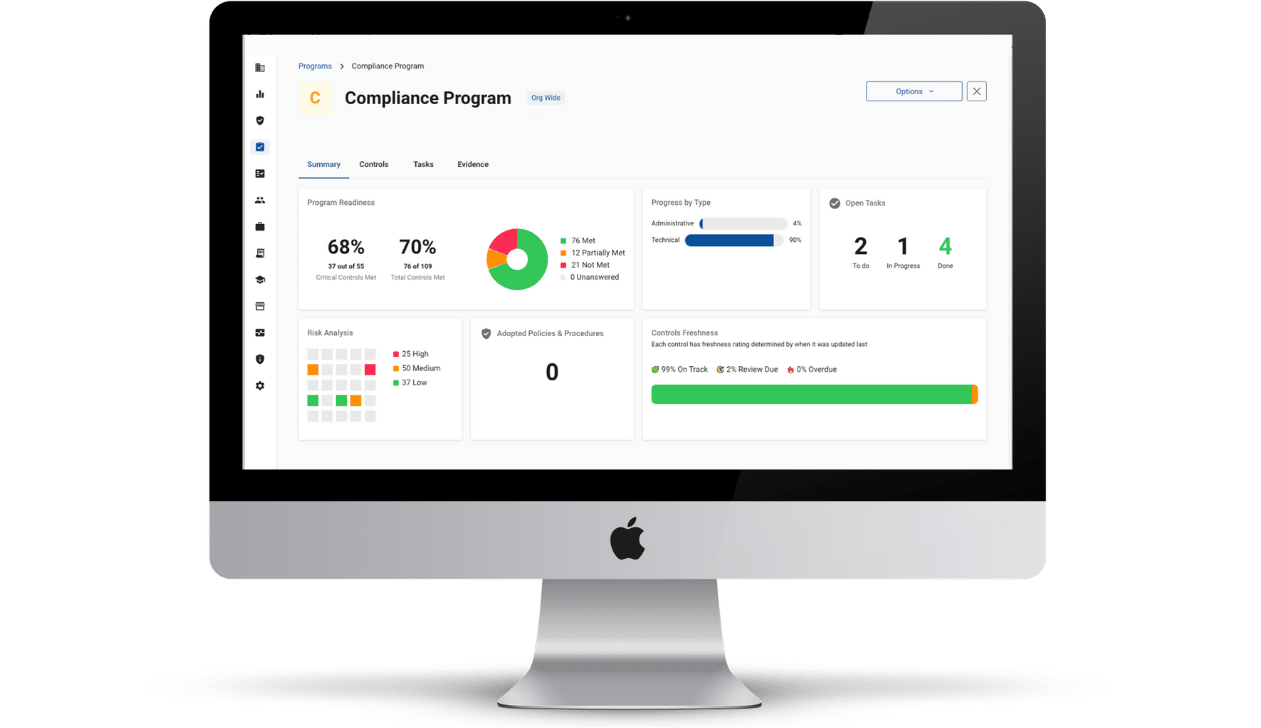

Compliancy Group’s automated HIPAA solution, “The Guard,” is designed to cut through the confusing aspects of the law by simplifying the compliance process. Our proven solution is designed to meet you where your business is and guide you to achieve full compliance.

The Guard is the tracking tool that keeps you up to date on tasks that need to be completed. It also creates a record of your efforts. HIPAA requires that you be able to show what you have done to achieve compliance in case of a breach or audit. Along the way, you learn what HIPAA requires and gain the confidence of knowing that you fully comply with the regulations.